Get Delivery Challan Under GST Bapuji best (since 1948)

A delivery challan is a document created by a seller when goods of any kind are delivered through shipment. Such a delivery needn't necessarily amount to a sale. For example, if there is a transfer of goods that takes place between a head office and a branch office, it does not result in a sale but still requires the issue of a delivery challan

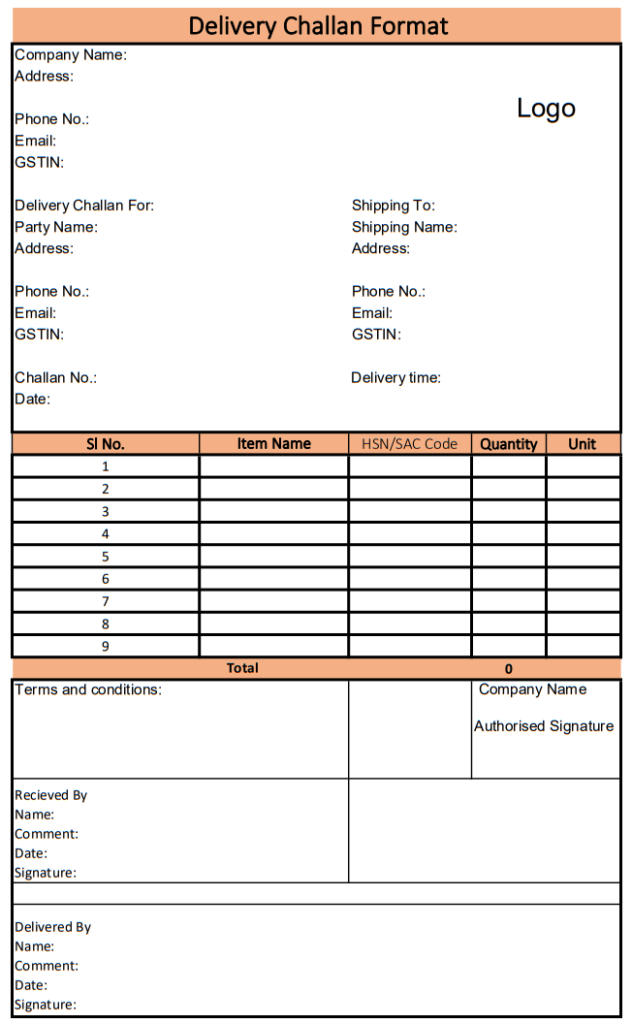

Delivery Challan Format in Word Free Download Delivery Challan Format

Delivery Challan Format PDF. Vyapar helps create delivery challan using professional PDF formats. These delivery challans are produced in a format that makes it seamless for sellers to track orders. This app is a boon for businesses in managing their delivery consignments. Download for Desktop.

Delivery Challan PDF Format PDF

15,694 templates. Beige Illustrative Sushi Food Delivery Instagram Story. Your Story by elversa. Beige Yellow Illusrated 3D Fast Delivery Instagram Post. Instagram Post by Lemannas. Brown & Beige Modern Delivery Instagram Post. Instagram Post by People Of Design. Free Delivery Yellow 3d Instagram Post. Instagram Post by Bruno Mineiro.

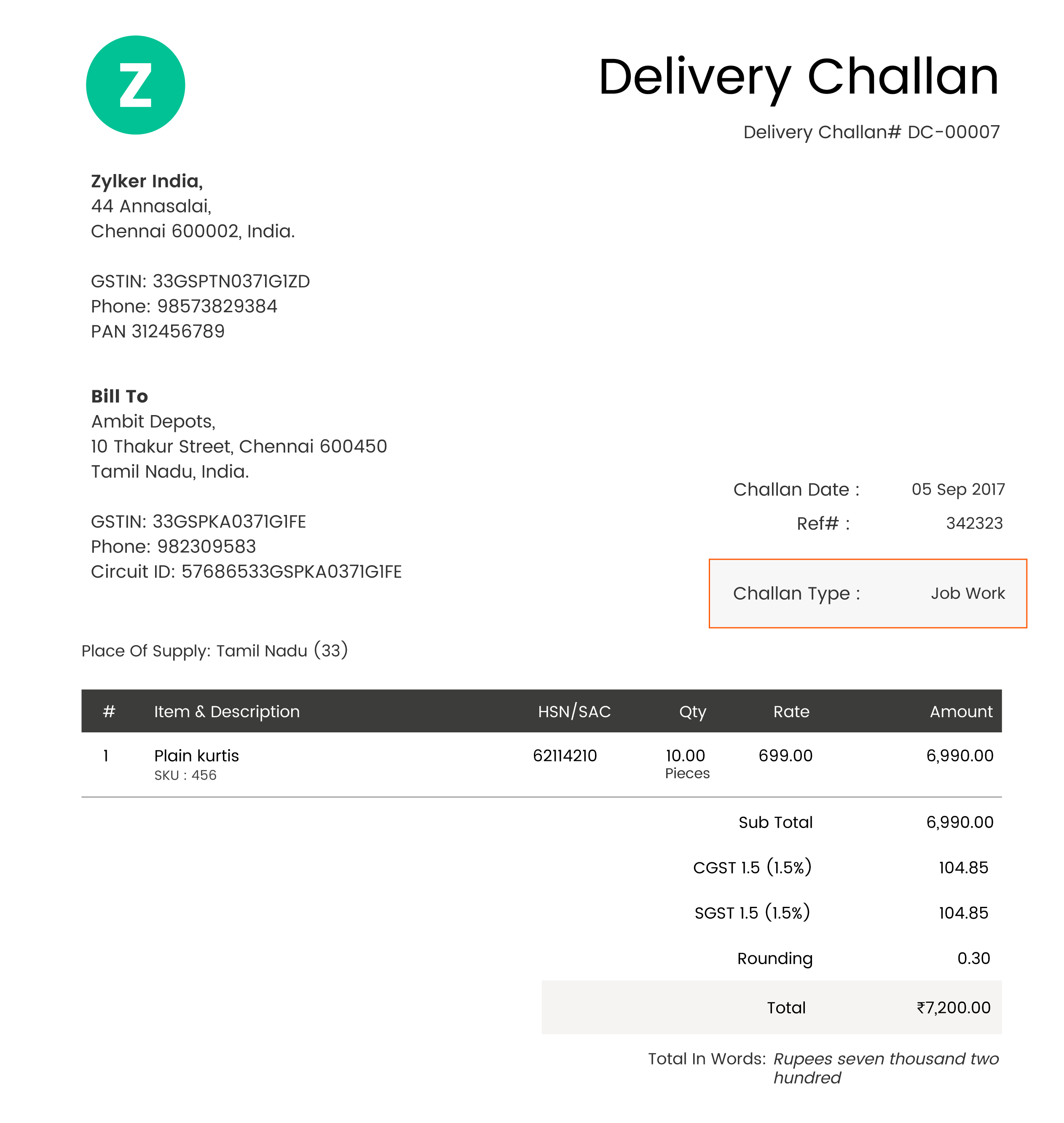

Delivery Challan Zoho Books

A delivery challan is also prepared during a sale transaction. It acts as a proof that the item has been delivered to the customer. When the customer receives the item, they sign the delivery challan and keep a copy of it. However, a delivery challan shouldn't be mistaken for an invoice, because it doesn't give any right to legal ownership.

Delivery Challan Printing Delivery Challan Printing Manufacturer, Service Provider & Supplier

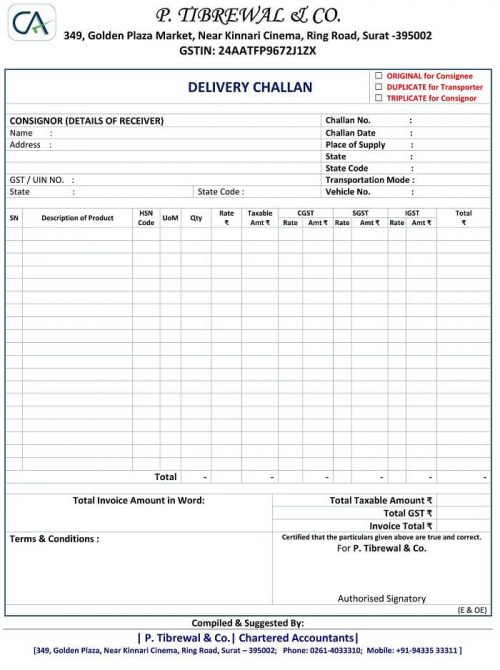

A delivery challan is also called a dispatch challan or a delivery slip. It is sent along with the goods shipped for delivery and contains the details of the goods being transported. Three copies of delivery challan must be created and should be marked as follows: Copies of Delivery Challan. Used By.

Printed Delivery Challan Form Manufacturer from Mumbai

A material delivery challan is a formal document issued for the sole purpose of transporting goods. On the contrary, a tax invoice is issued when there is a supply of goods. A tax invoice is also issued when then the payment has been received by the supplier. A delivery challan may show the value of the product worth sometimes.

Delivery Challan Archives CA CLUB

Delivery Challan Format Word. Vyapar can help you manage and issue delivery challan using word formats seamlessly. Over 5 million small business owners trust Vyapar for issuing delivery challans and creating invoices for their customers in India. Using the app to create delivery challan using free word formats is effortless.

Delivery Challan Format_page0001 Tax Shastra

Yes. A delivery challan is a legal document that can sometimes be used for transporting goods without an invoice. Delivery challan is issued as per the provisions of Section 31 of the CGST Act and Rule 55 of the CGST Rules. Delivery challan should contain the details of the goods, the consignor and the consignee, and the tax amount, if applicable.

Delivery Challan 14cm X 22cm 50 Sets Anupam Stationery

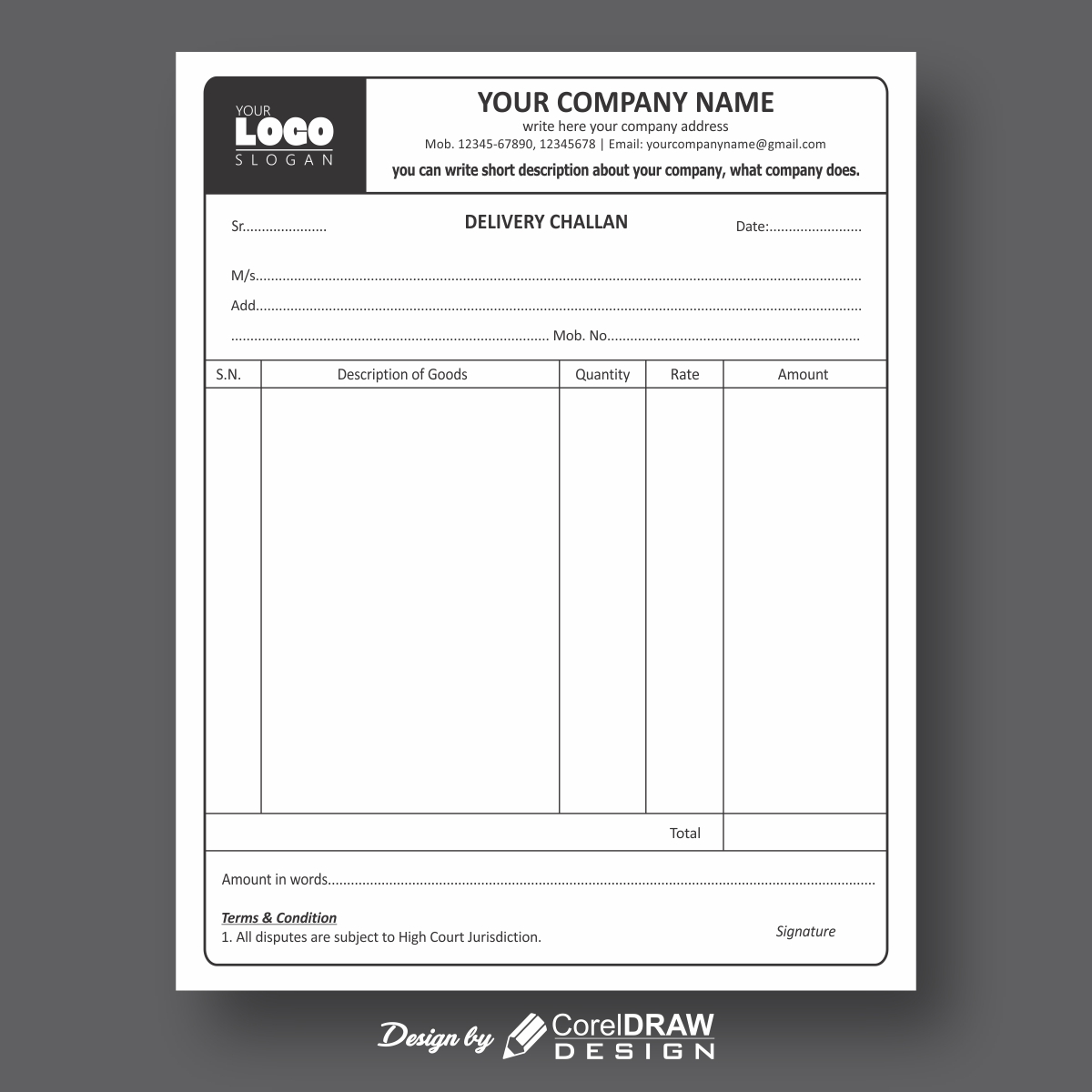

A delivery challan is a document to track product or material shipments. 6. Is a delivery challan a digital document? A delivery challan is not a digital document. It is a physical document the supplier must generate and give to the customer after receiving the goods. 7. What is the format of the delivery challan? Delivery challans can be in.

Delivery Challan Pdf Transport Vehicles Gambaran

The main objective of a delivery challan is to record the delivery or shipment of the goods by the seller. It also serves as a record of receipt for the consignee or the recipient and helps them follow up on an invoice. From a supplier's point of view, they act as proof of goods dispatched and provide data for inventory management and.

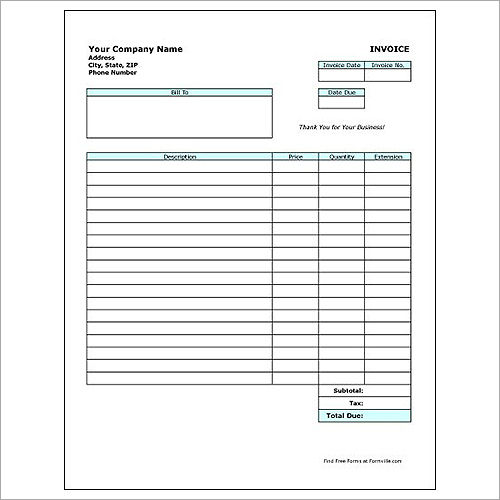

Delivery Challan Delivery Challan Format in Excel, Word & PDF

A delivery challan is a document used in commercial transactions to record the transfer of goods from one party to another. It serves as proof of delivery and includes details such as the description of the goods, quantity, and date of delivery. This document is commonly used for internal record-keeping, to facilitate invoicing, and for tax.

Free Delivery Challan Template Zoho Inventory

In these cases, instead of a tax invoice, a delivery challan is issued. Therefore, a delivery challan is a document that permits the transportation of goods from one place to another. It also goes by the name dispatch slip or delivery slip. Rule 55 (2) of the CGST Rules, delivery challans must be issued in three copies as follows-.

Delivery Challans Excel format GST Word Format Free Download

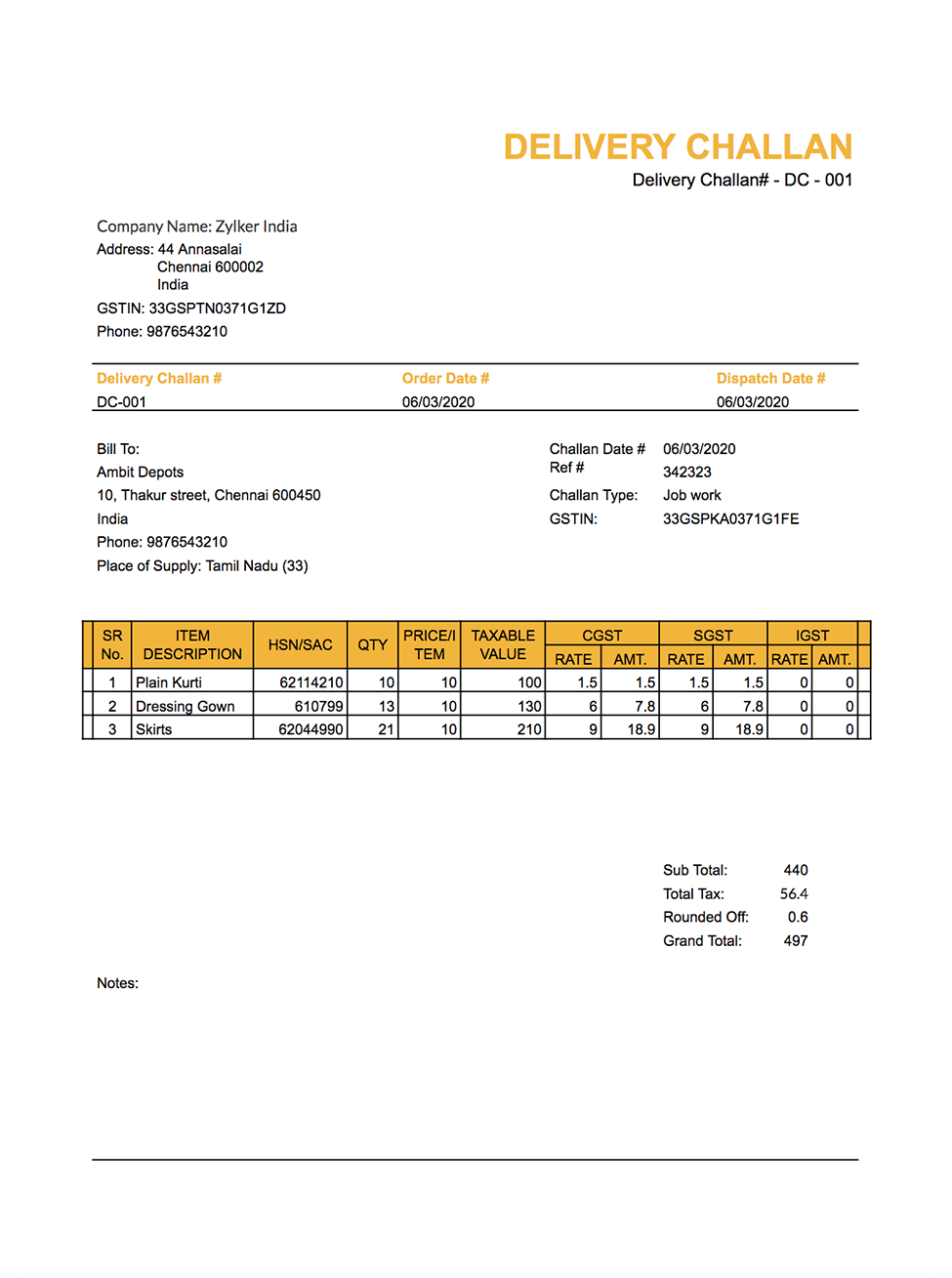

Delivery Challan Format for Job Work. There is no specific format for a Delivery Challan under the GST Law. However, CGST Rules prescribe the specific particulars it must contain, such as date, supplier and job worker details, their GSTIN, description of goods, etc based on those requirements, let's understand how to create a Delivery challan.

Delivery Challan Printing Service, Challan Book, Delivery Challan Book, Delivery Challan, Bill

Download GST Delivery Challan Format PDF, Word and Excel File. We have provided the sample GST delivery challan format PDF, Word, and Excel files. The following files should be downloaded and edited. For any help, you can write to us at [email protected] or directly Whatsapp us. To read more about GST Articles.

Understanding Delivery Challan Detailed Format And Usage

A delivery challan is an official document which is issued by businesses that sell products. It is used from the perspective of the Goods and Services Tax (GST). It serves as a record of the goods that are transported from one place to another. The main purpose is to track the goods while they are being transported.

Delivery Challan Gambaran

Delivery challans must be serially numbered not exceeding sixteen characters, in one or multiple series. The format of the delivery challan should contain the following information: Date and number. Name, address and GSTIN of the consigner, if registered. Name, address and GSTIN or Unique Identity Number of the consignee, if registered.